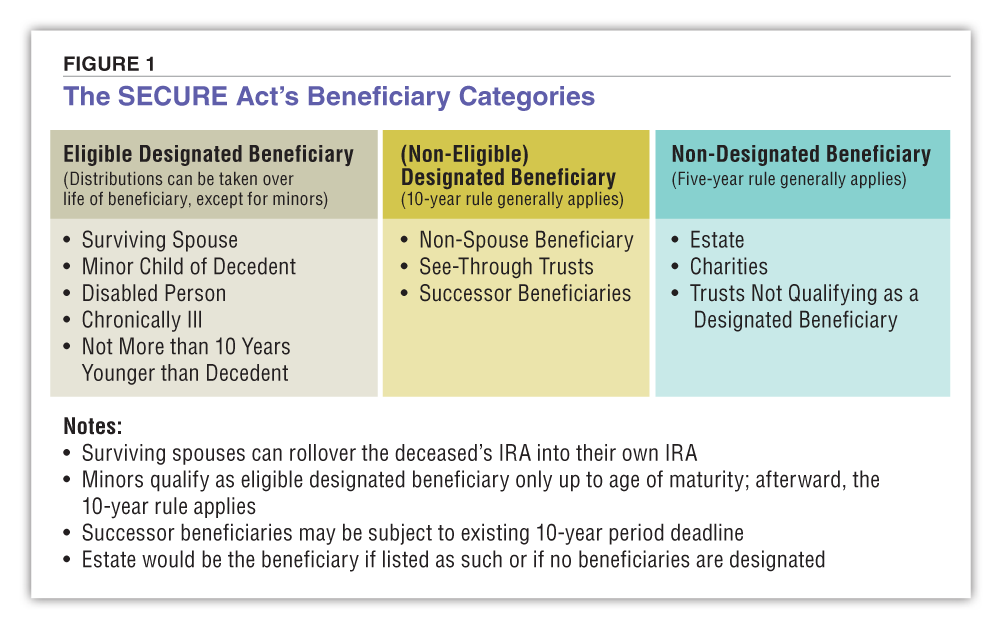

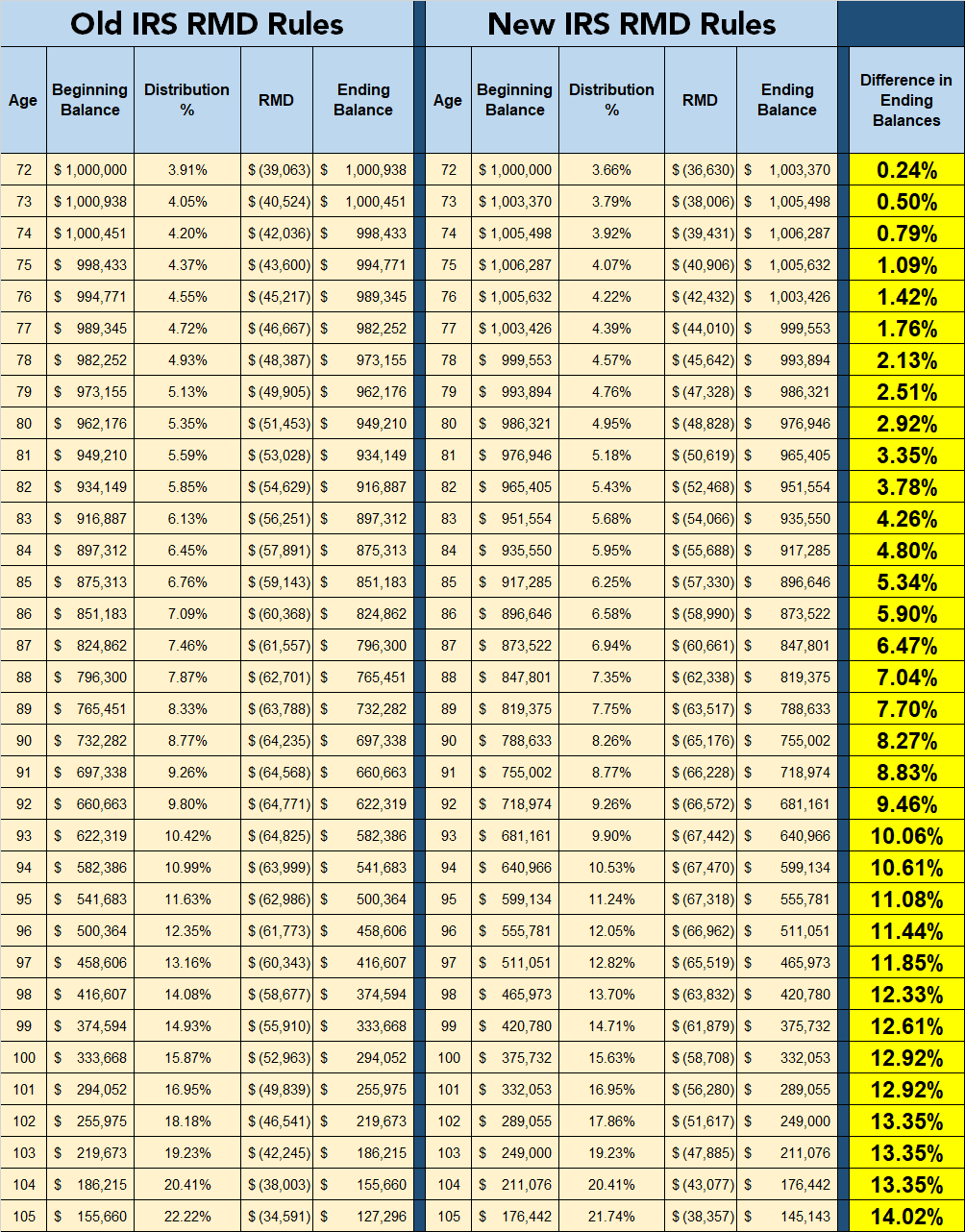

2025 Inherited Ira Rules - New Guidelines For Your Required Minimum Distributions (RMD) coming in, Ed slott, cpa, and bob keebler, cpa/pfs, discuss the complicated inherited ira rmd rules and what is required in 2023 and 2025 in this episode of the pfp section podcast. Withdrawing from an inherited ira. The irs has resolved a dispute over new rules for inherited iras by punting enforcement of new withdrawal guidelines to 2023. The secure act requires most beneficiaries of an ira to begin drawing down their inherited account within ten years of the owner’s death.

New Guidelines For Your Required Minimum Distributions (RMD) coming in, Ed slott, cpa, and bob keebler, cpa/pfs, discuss the complicated inherited ira rmd rules and what is required in 2023 and 2025 in this episode of the pfp section podcast. Withdrawing from an inherited ira.

Successor Beneficiary RMDs After Inherited IRA Beneficiary Passes, Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death. Secure act rewrites the rules on stretch iras.

You’ve inherited an IRA. What happens next? CD Wealth Management, New rules for inherited iras could leave some heirs with a hefty tax bill. The dispute concerned secure act regulations that changed the.

The irs announced a delay of final rules governing inherited ira rmds — to 2025.

IRS Notice 202354 Provides Relief, Guidance Regarding RMDs, Best roth ira for mobile trading. The secure act requires most beneficiaries of an ira to begin drawing down their inherited account within ten years of the owner's death.

New rules for inherited iras could leave some heirs with a hefty tax bill.

Mens Shorts Styles 2025. The 2023 guide to men's shorts styles & fashion trends. The […]

Where Is Wwe Backlash 2025. Scheduled for may 4, 2025, the event is set to […]

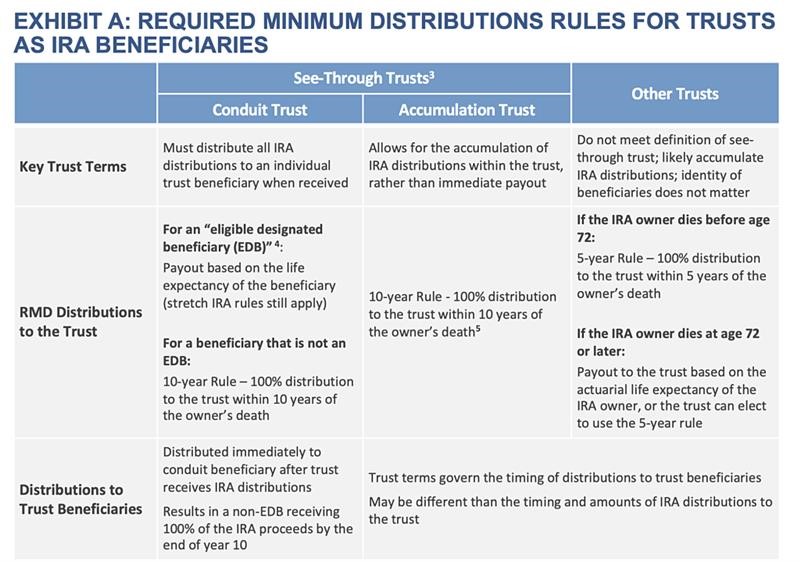

The setting every community up for retirement enhancement (secure).

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)

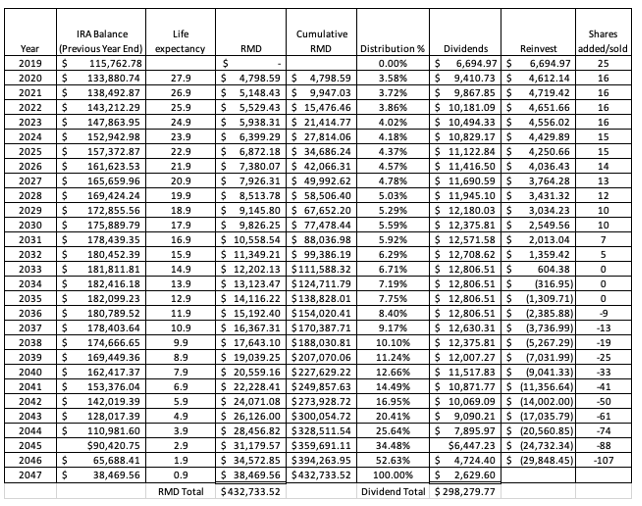

Inherited Ira Distribution Table 1, In the first quarter of 2023, americans held more. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death;

Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death.